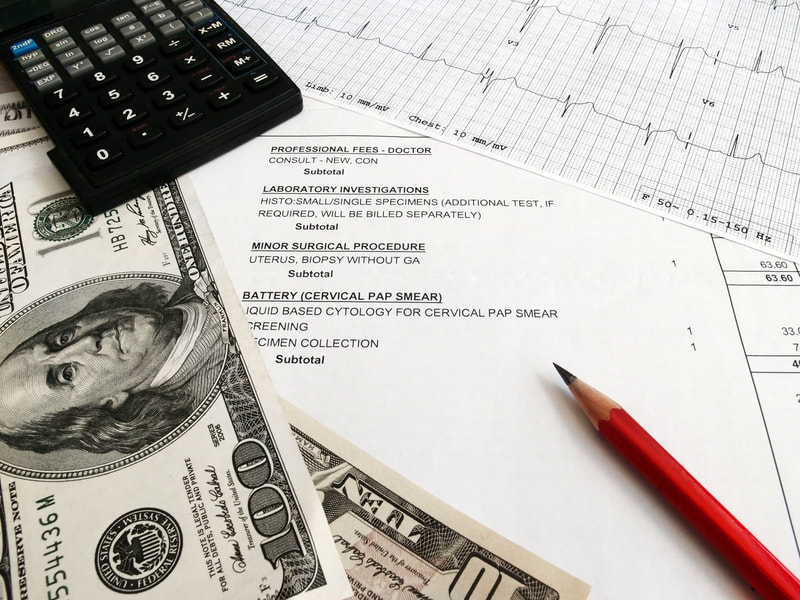

If you are planning on going into retirement soon, you might also be worried about what happens when you are no longer on the insurance provided by your job. You might be afraid of the possibility of a major injury and how you will be able to pay for it. Luckily, there are a couple options in place to help you pay for these kinds of expenses.

Long-Term Care Insurance

To clarify, long-term care in medicine is anything that requires more medical attention over an extended period of time. This includes things like chronic illness or some retirement facilities. For that reason, you can get long-term care insurance. The best time to apply is before you retire because it becomes more difficult if you wait until you need it. Insurance companies do not want to take on someone who already has illnesses because then they are not making as much money off of you than someone who is perfectly healthy.

Reverse Mortgages

Converting your home equity to cash is often an option to pay for a senior living facility. If you are moving out of your home, you no longer need it anyways, so a reverse mortgage allows you to make money off of something you already paid for. However, you cannot do a reverse mortgage unless your home is completely paid off. This poses an issue if you recently bought your house and have not been able to fully buy it yet. A similar option would be to sell the home instead.

Save by Deducting

Taking off from your taxes because of your retirement is a great way to save money that can be used to pay for long-term medical expenses. Typically, you can deduct any expense related to long term care if you are part of the insurance plan. You also need to provide evidence of what care you got and why you needed it. This helps you or your accountant to know how much to deduct off your taxes. Deductions are meant to benefit those who need it, and as a non-working citizen, you rely on any help you can get.

Long-term illnesses or homes are already expensive and often sad for everyone involved. By implementing these payment ideas now and in the future, you will no longer have to worry about your 80s and 90s because you know that you will be taken care of.

Looking to reduce the stress of your retirement? Check out this free book offer!

RSS Feed

RSS Feed